Breaking it Down

Our portfolio creation and ongoing active management has a simple goal: maintain investment portfolios that seek to maximize returns and minimize risk. While this may seem a tall task, we utilize the expertise of Nobel-Prize-Winning Research to do so.

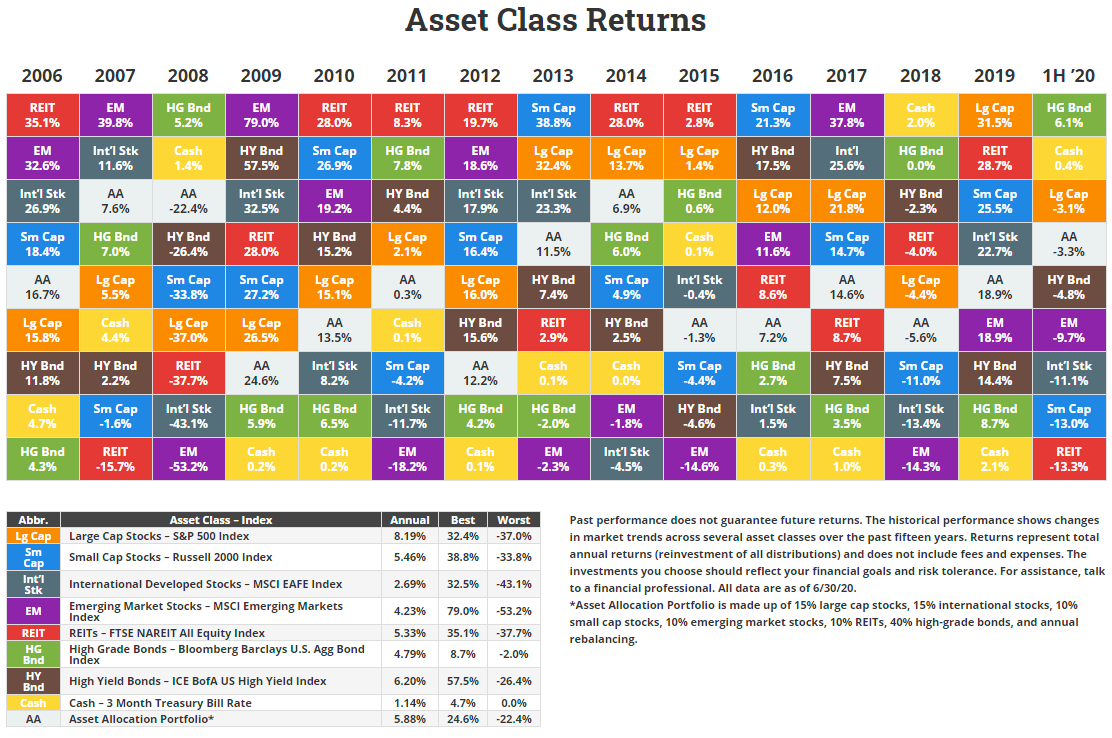

Harry Markowitz won the Nobel Prize in Economics in 1990 for what he called “Modern Portfolio Theory.” To summarize his teachings in one statement: Diversification can significantly reduce risk. In the table below, each color represents a different type of investment. The Orange Large Cap Growth boxes include big stocks with higher forecasted growth rates (think Apple and Facebook). If you’ve invested in this category, you had some major gains (32.4% in 2013 looks really good), but there were also some major losses (-37% in 2008 is certainly poor). This pattern of gains and losses is not unique to larger stocks and may be applied to most types of investments, aside from the more conservative cash and fixed income allocations. The stock market will provide profitable returns in some years and less fortunate ones in others. It is almost impossible to predict which investments will provide the highest returns each year.

There is a way to minimize the effects of the unpredictable ebb and flow of the markets. Look at the Gray boxes, each representing a diversified “Asset Allocation Portfolio”. These boxes illustrate the returns you would have received if you had some of your eggs in each basket.1 Unlike the volatility of the individual categories, you’ll see that the diversified portfolio has historically trended towards the middle. This is the beauty of diversification: If you hold some of everything, you may reduce risk without necessarily sacrificing returns. By adding in real estate*, commodities and opportunistic investments through our ‘Demand Classic’ portfolio, you may experience the positive effects of diversification on an even broader scale.

This is what laid the foundation for each of our portfolios. Through a focused questionnaire, we look at your specific circumstances and determine how many of your eggs we should put in each basket. If you are younger or focused on growth, you may be able to handle more volatility in your portfolio, which would mean your portfolio would be invested in a higher concentration of stocks. If you are older or focused on income, you might need more protection, so your portfolio will be centered more on fixed income. But, no matter your situation, you can rest assured knowing that your portfolio is diversified to fit your needs and values.

Investment Selection

Making sure that your investments are globally diversified and properly aligned is of paramount importance at Demand Wealth. Based on the results of your risk tolerance questionnaire, the appropriate allocation from 11 models within the ‘Demand Classic’ portfolio will be recommended. For example, a conservative investor will have a portfolio containing mostly bonds and light exposure to stocks, such as the ‘Demand Classic’ 10/90 (10% Stocks/90% Bonds). The opposite end of the spectrum holds true for someone more aggressive, where a 70/30 or 80/20 allocation containing mostly stocks and only a few bonds is more appropriate. Low fees, solid managers, low tracking error and high sharpe ratios are also factored in.

Low Expense Ratios

Past performance of an investment does not indicate future performance. There is significant uncertainty in the investment world, but throughout that uncertainty, there is one constant: fees. Every fund has an expense ratio: this is the fee that a manager collects for managing each fund and is expressed as a percentage of the money that you have invested. The average ETF expense ratio is currently around 0.44%. While this may seem negligible, if your nest egg grows to $100,000, you end up paying $440 a year.

This is why we choose funds with lower expense ratios. On average, our portfolios have an expense ratio of 0.13%, so less of your money is going to managers and more of it is staying invested.

Reputable Managers

Even though past performance can’t predict future returns, fund managers can serve as a clue to a fund’s quality. We sort through thousands of funds and carefully select those with reputable managers.

Low Tracking Error

While Demand Wealth provides an actively managed overlay, most of the funds included in our portfolios are “Passive Funds.” Passive funds that follow an index, such as the S&P 500, generally have lower expense ratios and have historically outperformed actively managed funds. However, some passive funds track their underlying index more closely than others. The further away passive funds get from tracking the index, the more likely they are to deviate from that index. We account for this by selecting funds that historically have low tracking errors.

High Sharpe Ratio

Imagine you are deciding between two different funds: Fund A and Fund B. One has an expected return of 10%, while the other has an expected return of 7%. At first glance, Fund A would seem to be the much better option. However, if Fund A took on significantly more risk than Fund B, then Fund B could have a better risk-adjusted return. That’s why it’s so important to consider risk as well as return when looking at investment options.

The Sharpe Ratio gives insight into this characteristic. An investment’s Sharpe Ratio helps quantify how much return you’re getting compared to the amount of risk that you’re taking. Our portfolios are managed to contain funds that have yielded solid returns while taking on less relative risk.

Portfolio Management Strategies

The portfolios are continually being monitored by our team of financial professionals and we are constantly looking for opportunities to optimize portfolios via Tax Loss Harvesting and Rebalancing strategies.

Tax Loss Harvesting

If you have a taxable account with multiple holdings, there is a good chance there will be some down positions, even in a year when your total portfolio is net positive. Tax loss harvesting is the process of selling investments at losses, which can provide a tax deduction (for 2020 up to a -$3000/ year loss can be written off against your annual income).

Annually we will analyze the positions in your non-retirement accounts then sell the appropriate losses and repurchase them after the 31 day wash sale rule has been satisfied. During this interim period, those funds will be invested in a placeholder similar to the sold position, so your money stays invested.

Rebalancing

Portfolio rebalancing is a staple of effective investment management. Demand Wealth sets your portfolio to an optimal allocation of stocks, bonds and real estate. This allocation will change over time as market conditions and investment performance evolve. Rebalancing is the discipline of resetting your portfolio back to its original optimal allocation. For example, if a 50% stock/50% bond portfolio evolves to be 57% stocks/43% bonds after a period of time. Rebalancing involves selling enough stocks and buying enough bonds to reset your portfolio back to its appropriate 50%/50% allocation. Of course, as your financial situation changes, Demand Wealth works to ensure that your portfolio stays properly diversified, optimized and in sync with your financial goals.

The Demand Wealth rebalancing process is performed by our skilled team. Unlike many of the robo-strategies, which rebalance at a defined interval (e.g. +/-10%), a Demand Wealth Portfolio Manager rebalances when it makes optimal sense. We also incorporate macroeconomic factors which may evolve over years, rather than months, that current computing models simply aren’t able to perform.

Demand More from your investments, planning and advice. Open a portfolio with us today.

1 Asset Allocation Portfolio is made up of 15% Large Cap stocks, 15% International stocks, 10% Small Cap stocks, 10% Emerging Markets stocks, 10% Real Estate, 40% High-Grade bonds and Annual Rebalancing.

* Accounts below $5,000 will NOT have a Real Estate component.