The New York Stock Exchange (NYSE) opened on May 17, 1792. Since then, financial professionals have been the dominant force in the capital markets using their expertise to achieve impressive returns. They act on behalf of banks, funds, and money managers: collectively referred to as institutional investors. But recently, individuals have created a distinguished position in the markets, giving you all the more reason to start investing today. Here are five ways investing has changed to favor the individual vs. institutional investor.

Commission-Free Trading

Charles Schwab became the first discount broker in 1975 and has offered top-tier, low-cost investment products to its investors since. However, when Robinhood Markets introduced “zero-commission” trading in 2013, it attracted a fleet of young and hungry investors with an appetite for its cost-effective structure and simplicity of the mobile application. Six years later, on October 1st, 2019, Schwab announced “commission-free” trading, pushing its competitors such as Fidelity, E-Trade, and TD Ameritrade to follow. As the discount broker behemoth, Schwab headed the online brokerage industry in eliminating costs tied to trade execution. Investors no longer incur expenses associated with each transaction and essentially keep the entirety of their capital gains (less any payments for order flow, i.e., marginally lower sell prices). Evidently, this has created an upsurge of individual investors as online trading is now “free.”

Social Media

Digital marketing is at the forefront of today’s advertising. Technological advances have created a mobile world where nearly everyone has a smartphone. Advertisements appear on websites, in emails, and on popular social media platforms such as Instagram and TikTok. The mobile applications and ability to move quickly through posts have developed social media into a marketing hotbed. Unlike outdated methods such as billboards, social media attracts higher viewing rates encouraging companies to advertise digitally. Since the inception of commission-free trading, the trading volume of individuals has substantially increased and investors subsequently discuss their success online. Between online discussion and digital marketing, people are learning how to invest and opening brokerage accounts faster than ever before. According to the Wall Street Journal, over 10 million new brokerage accounts were opened in the first half of 2021, matching the total for all of 2020.

Covid-19 Pandemic

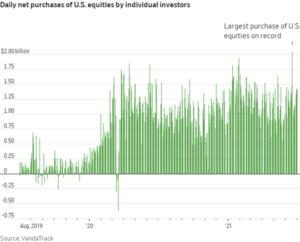

The novel Coronavirus pandemic caused a global economic shutdown in 2020 delivering alarming statistics. Year-over-year percentage change in consumer prices (CPI) dropped to 0.10% in May 2020 (its lowest since May 2015); unemployment reached an all-time high of 14.80% in April 2020 compared to the 5.77% average since 1948 (U.S. Bureau of Labor Statistics). In a virtual environment, people had more time on their hands. Coupled with the reduction in consumer spending, Covid-19 stimulus packages provided Americans with more cash. The pandemic halted travel, leisure, and sports, so people searched for alternative ways to spend their time and money. When the Dow Jones Industrial Average (DJIA) entered a bear market in March 2020, individuals poured money into discounted stock prices. Notice the spike in volume of U.S. equity purchases by individual investors after the first quarter of 2020 in the chart from VandaTrack.

Individual vs. institutional investing skyrocketed throughout quarantine as it was an evident bargain and one of the limited available activities. Furthermore, we can observe the largest purchase of U.S. equities by individuals occurred in June 2021.

Behavioral Finance

As defined by Investopedia, “behavioral finance is an area of study focused on how psychological influences can affect market outcomes.” Hearing about massive returns in the stock market psychologically convinces people they can generate parallel returns. FOMO, an acronym for the “fear of missing out,” is a strong psychological component in the minds of individual investors. Individuals—to a degree—are afraid they will overlook a stock everyone else is trading or buy into the market too late. Considering how investors gloat about their profits, those who missed out previously will want to capitalize on future opportunities. This has contributed to rising interest in the stock market from individual investors. For example, online forums such as Wall Street Bets rallied individual investors together to pump up so-called “meme stocks” like GameStop (GME) and AMC Entertainment (AMC) in an effort to exploit the massive short positions of powerhouse hedge funds. Many individual investors followed the herd in speculation on these meme stocks as they wanted a piece of the action. Even those who did not have skin in the game surely were disappointed they had missed out.

Blockchain Technology

Blockchain technology is used to facilitate, store, distribute, and protect decentralized payments. Bitcoin is by far, the largest (and original) cryptocurrency by market capitalization of $594 billion. Other notable crypto assets include the second largest, Ethereum ($274 billion), and the newest extension in the blockchain universe, nonfungible tokens (NFTs), which differ in valuation by each investor. Perhaps the most remarkable advancement by any crypto asset is Dogecoin, which was originally created as a joke! Promoted by individual investors and billionaire gurus such as Elon Musk and Mark Cuban, Dogecoin soared over 18,000% between April 2020 and April 2021. Aside from the volatile nature of crypto assets, individual investors have propagated growth for decentralized payments through large trading volumes. In fact, “digital gold” has become so widespread that the Federal Reserve is discussing the proposal of a digital dollar.

A Guide for Individual Investors

Regardless of the individual investor revolution, there will always be a demand for investment professionals as guides to managing wealth and risk along with providing planning expertise. Unlike decades past, there is access to a multitude of investment options: discount brokers, financial advisors, and hybrid robo-advisors. Demand Wealth is a hybrid robo-advisor and offers investment products and solutions tailored to your values. This means we create a portfolio tailored specifically to your beliefs, investment goals, and risk tolerance. We offer over a dozen theme-specific and globally diversified portfolios to choose from, e.g., Cruelty Free, Christian, and Blockchain. Schedule a zoom consultation with one of our experienced advisors to discuss your financial goals today.

This report is a publication of Demand Wealth. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change.